Quant Trading Technology | Engineered for Retail Traders

3x Breakout & 3x Pro Strategy

with Multiple Exit Hedge Fund Technology

3x Breakout is an Easy-To-Use super indicator while 3x Pro is an automated high-end execution and order routing algorithm developed to level the playing field for retail traders. You can now get advanced hedge fund caliber breakout trading technology developed for both new and professional traders! 3x Breakout strategy can be used to trade Stocks, Options, Futures, Forex, ETFs, and CFDs. Applications for Day Trading, Swing Trading, and Trend Trading.

Modeled after an actual Hedge Fund Breakout Strategy

Designed after an actual Hedge Fund breakout strategy that we used to manage six figure of real money in the markets. The predecessor to the 3x Breakout strategy helped us generate triple digit return in 5 months. In fact, this Breakout strategy could be one of the most powerful breakout strategies available! Our desk has researched many different types of trading strategies. Our goal was to develop the most effective strategies to manage firm’s portfolio. We selected a core set of back-tested trading strategies, and one of our core strategies was based on the Breakout Trading System. Our trading advantage involved developing the most robust trading strategies that could have the ability to trade many different asset classes and, in addition, that could also trade a wide variety of challenging market environments. We discovered that an optimized breakout strategy could be highly effective in trading markets that were experiencing good directional volatility or trending characteristics. We have worked hard to make a good thing better! We have made powerful enhancements to our original core breakout trading strategy concept by incorporating multiple profit target levels along with our modified trailing stop algorithm. The result is a powerful, easy-to-use breakout trading strategy that can be used to trade many different types of markets.

Trade Forex, Stocks, Options, ETFs, & Futures Markets.

3xBreakout strategy makes it easy to identify real-time Buy and Sell breakout signals in any market you trade right on your charting window. With clearly defined breakout entry and profit target exit levels, there is no confusion about where to enter or exit your trades. The labels displayed on the chart above highlight the breakout and profit target lines in the Breakout strategy.

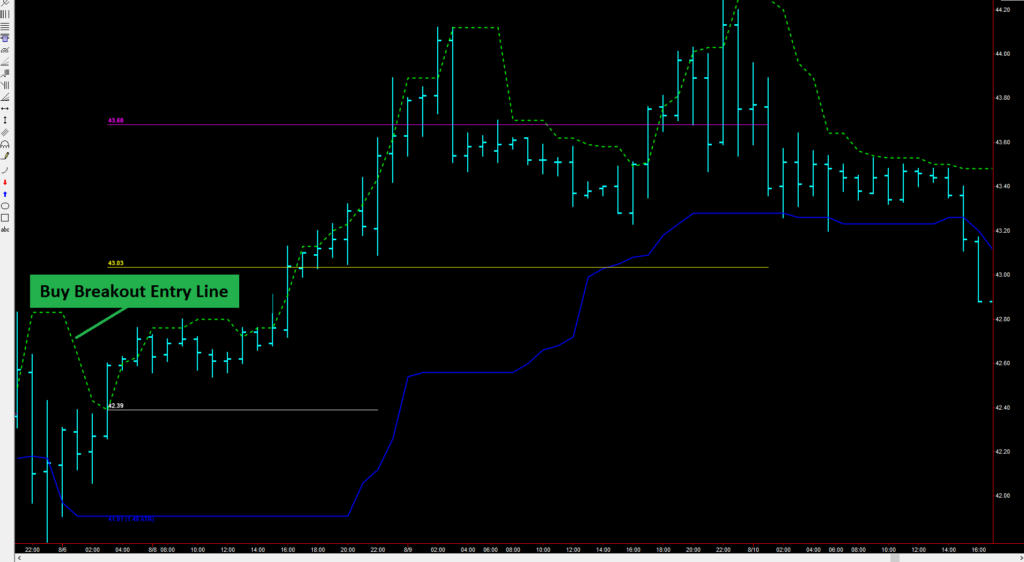

Trading the Breakout is easy! Here is how it works. If you identify a bullish trade setup and are looking to buy in a market, you would place your Buy Entry Stop at the level of the Dashed Green Line in the chart below.

When this level has been hit by your market, then the Breakout strategy will display your Breakout Trading Lines, which include your Entry Line (White), Profit Target #1 line (Yellow), and Profit Target #2 line (Magenta Line).

Once your Buy Entry Stop has been hit and you are long the market, then you should consider placing your Risk Management Stop below the solid blue Trailing Stop line (see chart above).

Breakout Buy Signal (Green Dashed) and Risk Trailing Stop (Solid Blue) Lines

Dashed Green Line (Buy Stop Entry Level)

Solid Blue Line (Risk Trailing Stop Exit)

Once you are long a market after your Buy Entry Stop is hit, then the Breakout trade lines are displayed to make it easy for you to either exit at Profit Targets or exit at your Trailing Stop line:

White Line is displayed at Buy or Sell Entry Level

Yellow Line is displayed at Profit Target #1

Magenta Line is displayed at Profit Target #2

Solid Blue Line is displayed at Trailing Risk Stop Level

Remove the guesswork with 3x Breakout

Professional traders will tell you that successful trading involves consistently applying a proven trading strategy to the markets over time. Most traders who lose money are relying on their emotions and discretion to determine where to Buy and Sell in markets. With our 3x Breakout Strategy, you have a powerful approach that removes the guesswork from trading and shows you exactly where to Buy, Sell, and Exit your trades. It doesn’t get any better than that!

Day Trade, Swing Trade or Trend Trade with 3x Breakout

There are not many trading strategies that you can use to Day Trade, Swing Trade, and Trend Trade. However, the 3x Breakout strategy can be highly effective at achieving profits with all of these types of trading. It is important to note, however, that there is a risk of loss when trading in the markets.

Euro Currency Trend Trade Example

When the Euro currency began to fall sharply against the US Dollar, our Breakout strategy was effective in identifying an excellent Sell Signal and was effective in capturing profits from the down trend with the Trailing Stop (see chart below).

Referencing the Euro Currency Short trade example in the chart above, you can see that for one contract you could have made $1,825 in profit by exiting at Profit Target #1, or you could have made $3,662 in profit by exiting at Profit Target #2, or you could have made $32,862 in profit by exiting at the Trailing Stop level.

3x Breakout makes it easy for you to not only see where to get into markets, but this powerful strategy also makes it easy for you to see where to exit markets as well. The above Euro currency example demonstrates the ability of the 3x Breakout to capture profits quickly or, in cases of very strong trending markets, capture profits from trending price moves as well (by exiting at the Trailing Stop).

In this case, the Trailing Stop would have been effective in profiting from the longer-term down trend move. By giving you three different exit opportunities, 3x Breakout offers flexibility for all types of trading, including day trading, swing trading, and trend trading. By changing the bar interval timeframe on your chart, you can focus on shorter-term or longer-term trades.

Ability to Profit from Selling Short

3x Breakout not only has the ability to profit from long trades, but also has the potential to profit from short trades as well by entering Sell signals at the Sell Entry Breakout level like the Euro currency example above.

Easy and Flexible Parameter Settings

Some trading strategies require you to learn complex parameter settings before you can effectively use the trading strategy. Not with our 3x Breakout. We have designed 3x Breakout strategy to include key parameters to give you the power and flexibility to modify entry and exit lookback periods, modify profit target levels, select line colors, and to even turn off breakout entry and profit target lines if you so desire.

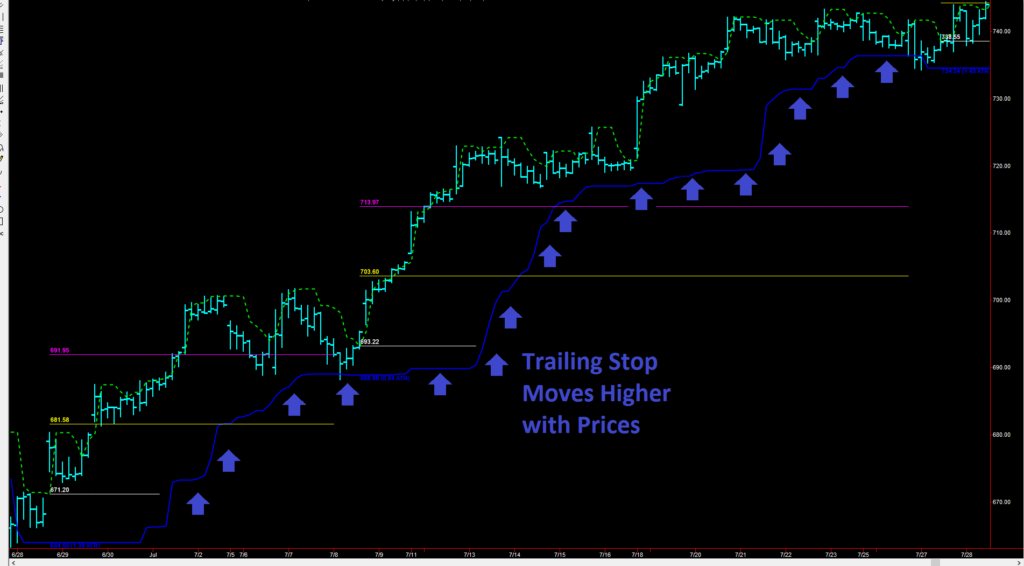

Powerful Trailing Stop Technology

Placing risk stops in the markets is one of the most challenging aspects of trading. 3x Breakout strategy has a powerful Trailing Stop algorithm that is designed to show you where to place your initial Risk Stops and, in addition, is designed to trail the market if prices move in your anticipated direction for profitable trades.

Once the 3x Breakout Trailing Stop moves past your entry price level, then you should have a risk free trade if you place your stop above your entry level (assuming that the market does not gap through your stop).

Because professional trading involves limiting losses, the 3x Breakout strategy enables you to quickly and easily identify a strategic location to place your Risk Stop. Notice in the chart below that for a Buy or Long position, the Trailing Stop follows price action as the trade becomes profitable. While the Trailing Stop initially acts as a risk management stop, it transforms into a trailing stop and becomes a great tool to lock in profits once prices move above (for long trades) your entry price level or below (for short trades) your entry price level.

Below is an example of where you would place your stop in a Sell or Short trade. In this case, the Trailing Stop is positioned above the entry price level and trails prices as the market moves lower. Your Buy Risk Stop would be placed above the blue Trailing Stop Line for short trades.

What Can You Expect?

Should you expect the 3x Breakout strategy to make money on every trade? No. The 3x Breakout strategy will have losing trades. No trading strategy can claim to have winning trades every time. However, we believe that our 3x Breakout strategy can generate impressive results when combined with high probability trade setups.

We recommend that you take the time to master this powerful trading tools. As with any skill in life, the more time you work with the 3x Breakout, the more you will learn to master this powerful trading strategy. And we believe that this will go a long ways in helping you to consistently achieve profitability in the markets.

Keep in mind that you many have streaks of winning trades and streaks of losing trades. The key is to think in terms of probabilities. Be selective with your trading opportunities. We believe that one of the most powerful ways to trade any market is to combine high probability trade setups with powerful trading signals, like those generated from the 3x Breakout strategy. If you trade the 3x Breakout in the forecasted direction of high probability trade setups, then we believe that you can achieve consistent profitability over time.

Designed to Cut Losses and offer Multiple Profit Exits

Any professional trader or hedge fund manager will tell you that you must cut your losses. 3x Breakout is designed with this age old trading wisdom in mind. If the 3x Breakout is wrong on a trade, it is designed to get you out quickly. If the 3x Breakout has a winning trade, it is designed to give you the flexibility to exit winning trades at one of three possible exit locations, including Profit Target #1, Profit Target #2, or the Trailing Stop.

The easy-to-use 3x Breakout puts advanced trading technology right on your chart, with the goal of giving you a major advantage over other traders in the markets!

3x Breakout for Day Trading

Many trading strategies are not made for Day Trading markets using 1 or 5 minute charts. 3x Breakout is different. This can be great for trading 1 or 5 minute charts across a number of markets, including ETFs, like in the DIA ETF in the example below.

Of the three trades displayed above, the 3x Breakout made maximum profits on the first and third trades as these trades hit both Profit Target #1 and Profit Target #2. The middle trade was a losing trade. The Buy example in the DIA chart above shows the power of the 3x Breakout to trade short-term time frames like 5 minute price bars. How is that for power and flexibility!

But it gets better! Not only can the 3x Breakout be used for Day Trading with Buy Signals, but you can also use the this powerful strategy to profit on Sell Short Signals as well. See the DIA Sell Signal example below.

3x Breakout works exactly the same way with short trades as with long trades, except the lines are positioned in reverse, with the Trailing Stop line above you Sell Entry Level and the Profit Targets below your Sell Entry Level.

Works to Profit in Volatile Markets

When you find markets experiencing higher volatility, the 3x Breakout strategy can be used in volatile markets to capture sizable profits in day trading. In the TSLA example below, you can see several trade examples using 15-minute price bars.

In the above TSLA example, after experiencing an initial loss of $0.98 per share on the first trade, 3x Breakout had four winning trades in a row. Including the first losing trade and the four winning trades, generating gross profits of $35.67 per share (not including commission and trading costs). Not bad for a volatile rally in TSLA stock!

How We Like to Trade the 3x Breakout

When it comes to profiting in the markets, you want to put the odds for success in your favor. A well-designed approach to trading that leverages the power of the 3x Breakout strategy can be a powerful approach to achieving consistent profitability in the markets.

We believe that one of the most powerful ways to trade the markets includes combining high probability trade setups with rule-based trade signals, like those generated by the 3x Breakout strategy. One way to trade is to look for high probability trade setups on a longer-term time frame and then apply the Breakout strategy on a shorter-term time frame, similar to the Soybeans example above.

We also recommend not trading against the trend unless you have a very reliable counter-trend trade setup. Trading in the same direction of the trend will put the odds in your favor. In addition, you do not want to trade after a setup has expired. In other words, every trade setup has an effective forecasting period called a shelf life. Once a trade setup shelf life has expired, you do not want to continue taking trades based on the trade setup because its effectiveness has dissipated and you no longer have a trading edge based on the setup.

It is not a good idea to trade in choppy, sideways markets where there is little price volatility. We recommend that you select markets that are experiencing good directional volatility when trading with the 3x Breakout strategy.

Get the 3x Breakout Advantage Today!

New traders and professional traders alike can benefit from the power of the 3x Breakout strategy for day trading, swing trading, and trend trading. Our powerful 3x Breakout strategy can be used to trade Stocks, Bonds, ETFs, Options, Futures, FOREX, and CFDs. Now you can combine the power of high probability trade setups with the 3x Breakout strategy to remove the guesswork from your trading. You no longer need to wonder where to Buy, Sell, or where to place your Risk Stops. The 3x Breakout gives you the flexibility of exiting your profitable trades at two optimal Profit Targets or at the Trailing Stop. Click the button below to begin enjoying the advantages of the 3x Breakout strategy!

This trading tool costs $797 and is available for Meta Trader 4, NinjaTrader 7, Thinkorswim, eSignal & TradeStation technologies.